Why do start-ups fail after launching their app?

There are many factors that contribute to the failure of a digital product, but many are rooted at the very beginning of product development: the product strategy.

To make sure your app earns a spot in the market, you need to nail down a variety of aspects before you start design and development.

In this article, I want to talk about what a lot of start-ups are not doing in their strategy phase if they have one in the first place. And why this will cause their eventual downfall.

#1 – Not defining core differentiators

It all starts with defining what your product has and what others don’t. What is the core value that you’re offering to your users that others can’t provide (yet)?

Shoutout to Mr. Bean

Shoutout to Mr. Bean

Creating a product that provides new value to your audience is great. This immediately sets you apart from your competitors. On the other hand, copying and reinventing your competitors’ products is what many start-ups have done in the past, and have found tremendous success.

Differentiators translate themselves in a variety of ways that target different types of consumers.

E.g: when you discover a population of underserved consumers that you want to target with a new product or service offering a better solution. Or you want to target all consumers in a market with a new product or service offering a better solution for significantly less money.

This means that you don’t have to come up with something totally different to attract customers: you have to innovate on what already exists.

You can define core differentiators by getting to know your audience’s needs and wants. You can do this by:

- Defining the market: this is a chance for you to uncover the problems customers are facing in the market. You can do this with a competitive analysis where you take a deep dive into the strengths and weaknesses of your competition. Becoming aware of your competition will allow you to capitalize on competitors’ flaws that consumers complain about.

- Discovering customer’s needs: Once you’re aware of the competition in your market you want to discover what needs for customers you can fulfill that your competitors haven’t (yet). The most definitive method of validating this is conducting qualitative user surveys & interviews. A well-designed survey can leverage data about users’ preferences and attitudes toward a product and feature. It’s also important to understand your customer’s needs on a larger scale. Conducting quantitative user research can help you answer some more data-centered questions. A great way of using quantitative research techniques is to discover the history behind your product and how it has evolved to where it is now.

- Recognizing opportunities: After collecting enough customer and market data you’ll be able to identify new opportunities for your feature set. This is a great opportunity to get together with your team and facilitate a workshop where you ideate opportunities for your product. Including your team members in this phase creates alignment that can prevent miscalculations in the process of product development.

- Differentiating your features: In the final phase, if done correctly you’re able to build out features that strongly resonate with your customers.

Image by Jason Goodman

#2 – Solving too few or too many problems at once

In addition to defining core differentiators; what problem are you solving? What are the needs you’re fulfilling?

I’ve noticed that too many start-ups are solving non-problems.

For example, let’s say that you’re building scuba gear for dogs.

Really getting to know your audience helps you define the problem that you want to solve. When you’ve found an issue or multiple ones, you must validate these through research and testing.

On the other hand, be cautious about solving too many problems at once. In some cases, I’ve seen that founders want to solve ten problems for five different audiences.

Make sure you prioritize solving one problem for one type of audience.

Yes, just one.

Niching down to one audience allows you to target a group more effectively. The consequence of solving too many problems can cause people to be distracted from the value that you’re providing. You want people to instantly be attracted to that one feature of your app that makes it different. That is what turns prospects into users.

Another consequence could be cognitive overload. Users will see too many things at once, which will cause an error in their brains. And eventually, they will click off because they’re confused.

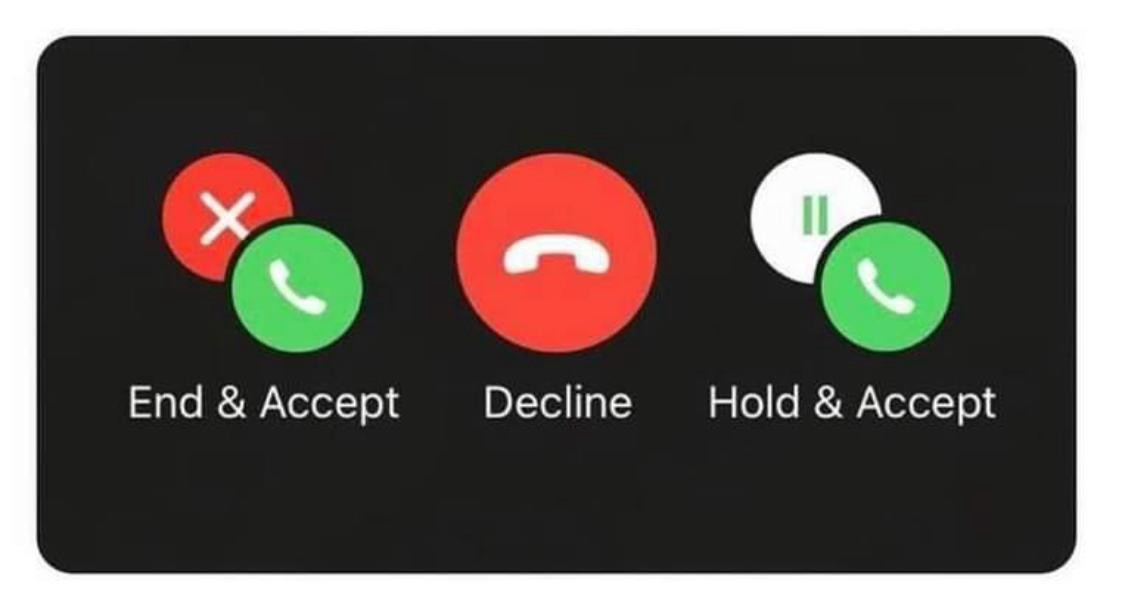

A great example of solving too many problems at once causing cognitive overload is the incoming caller screen Apple designed for IOS in 2020:

In this instance, a user would already be on a call and has to make a rapid decision whether they end their call and accept a new one, decline the call, or hold and accept.

Apple tried to solve too many problems on one screen which resulted in too many choices. This increases the chance of the user being confused and making the wrong decision.

#3 – Not having a proper adoption strategy

(Adoption = prospects that turn into users)

There are 5 types of adopters for products:

- innovators,

- early adopters,

- the early majority,

- the late majority,

- and laggards.

As a start-up, it’s essential to research these types of users and their behaviors.

This will allow you to understand where these fit into the product life cycle and can enable selective marketing and design activities that are focused on tapping into these adopters’ specific needs. This can improve a product’s chances of success.

- Innovators are the first type of users who are most likely to adopt your app. These are the so-called “thought leaders”; they’re curious, risk-takers, and excited by the possibilities of new ideas and new ways of doing things. They should be the first section to be targeted. You would expect the marketing team to identify these people very early during the product development (and not following a launch).

From a design perspective user research conducted with innovators can be very useful in developing prototypes before a more mass-market final design.

- Early adopters are the second group that should be targeted. These tend to be the most influential people within any market space and they will often have a degree of “thought leadership” for other potential adopters. They’re the ones who share your product on social media and leave reviews. The difference between this group and innovators is that they’re more risk-averse.

- The early majority, on the other hand, is likely to be targeted through more general marketing approaches and it is hoped that their connection with the early adopters will drive word-of-mouth sales. Designers may end up catering to the early majority through product iteration and offering improvements to the product.

- The late majority will arrive when the product has established itself in a particular niche in the market. Marketing to this group is likely to be less aggressive in direct marketing and more based on special offers and promotions to incentivize a choice of one product over another in a competitive arena.

- Laggards are the last ones to arrive at the adoption party, Laggards value traditional methods of doing things and are highly averse to change and risk. Targeting this group is probably not as effective as targeting early adopters.

#4 – A lack of disruptive vision

When I was talking about defining core differentiators, I mentioned that you don’t have to come up with a brand-new feature to deliver value to your customers. You can also copy and reinvent your competitors’ products.

But what if your competitor does that to your app?

Blackberry, Blockbuster, MySpace, and Hyves are excellent examples of companies with great value propositions but regrettable innovation strategies. Which caused them to have a short lifespan.

The reason that there even was a window of opportunity for competitors to disrupt their business model was that they weren’t innovating their products.

Looking forward into the future even when you’re still in the product strategy phase, can be very helpful in the long run. That’s why asking the following questions in the strategy phase is essential.

- How do we strategically position ourselves to enter this market?

- For each of our products, what is our direction for growth?

- How should our organization respond to the growing threat presented by XYZ disruptive company?

- Where will growth come from in the next 5 years?

- What innovations should we utilize to grow market share and better meet the needs of customers?

- How will we stay relevant to our customers as times change and new products and services enter the market?

Takeaways

To recap, validating the problem you want to solve with your users will ensure that you have a spot in the market before release. Having core differentiators will give you a competitive advantage.

You can find your core differentiators by:

- defining the market,

- discovering customers’ needs,

- recognizing opportunities,

- and finally differentiating features.

It’s also important that the problem you want to solve is something that the market needs. Avoid solving non-problems.

Additionally, it’s crucial to look at the adoption of your product. Consider who is going to use your products first after the release. And what type of people will follow.

Finally, maintaining an innovative scope after release is going to make sure that no one is going to disrupt your business model.

Tackling these factors early in the product strategy won’t automatically set you up for success, but it will help you get ahead of the game.

9/10 start-ups are not considering these elements in their strategies which plays a big role in their failure.

Bobby Gill