Rollovers For Business Start-ups (ROBS)

One of the most challenging hurdles aspiring business owners face is securing adequate financing to get their business up and running. The down payment and eligibility requirements for obtaining a traditional small business loan can be a struggle for many borrowers to meet. But there are other forms of funding available that don’t force you to risk your house as collateral or start your business saddled with debt.

Rollovers for Business Start-ups (ROBS) is a financing method that lets entrepreneurs use their retirement funds to start or buy a small business or franchise — with a fast, tax penalty-free transaction.

What Is ROBS?

ROBS, also known as 401(k) business financing, has been a funding option since 1974 when Congress passed the Employee Retirement Income Security Act (ERISA). This act shifted the responsibility of retirement savings from the employer to the employee and now allows employees to use their retirement funds in ways they see fit – including starting or buying their own business.

While some might get nervous about using retirement funds for anything but saving, ROBS opens the door to entrepreneurship without closing the door on retirement. Instead of your retirement money going into a volatile market; your money goes into financing your own business with ROBS. 401(k) business financing is simply a way to invest in yourself – and your dreams.

Qualifying for ROBS is Simple

Unlike traditional business loans, there aren’t many eligibility requirements for ROBS. The one essential requirement for ROBS funding is that you have at least $50,000 in an eligible retirement account. This makes sure that the tax benefits you receive from ROBS outweigh the associated fees for working with a ROBS provider. While you can complete ROBS with less money, it’s not something we recommend. Also, while most retirement funds are considered “rollable,” Roth funds are a notable exception and aren’t eligible for ROBS.

The first step to getting started with ROBS is to find a third-party provider who can help you properly complete the process. Because each ROBS step can be complex and must be completed following IRS and DOL guidelines to avoid triggering any tax penalties, a qualified, experienced ROBS provider can make sure you stay in compliance and help you complete the process quickly and easily.

How Does ROBS Work?

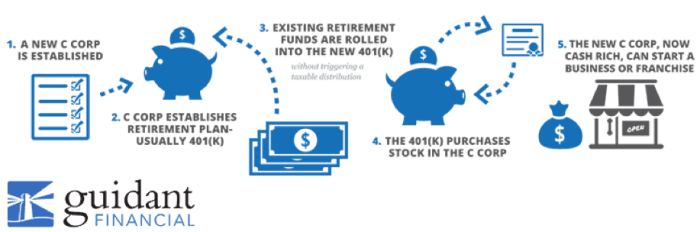

Step 1 – C-corporation

A new business is established as a C corporation, a type of business entity that is taxed separately from its owners or shareholders. It’s also possible to convert an existing business, such as an S corporation (another type of entity where owners or shareholders are subject to tax on their shares) to a C corp.

Step 2 – 401(k) Plan

The new corporation creates (or opens) a new 401(k) plan, which can purchase private stock.

Step 3 – Rollover

Funds from the existing retirement account are rolled into the new 401(k) plan.

Step 4 – Stock Purchase

The 401(k) plan purchases stock in the new C corp, resulting in a cash-rich entity.

Step 5 – Debt-free Business

The funds can now be used for small business needs. For example, ROBS funds can be used to start a new business, buy an existing business, purchase a franchise or multiple franchise locations, or even act as the down payment on an SBA loan.

The Funding Advantages of ROBS

With ROBS, you can grow your retirement plan as you build up your business by contributing to your 401(k), but there’s nothing to pay back and no interest charged. While ROBS not being a loan is one of the biggest draws, there are also other factors to consider:

Build Up Your Business

Without monthly payments to make, you can more quickly reinvest your revenue back into building your business. This is essential to surviving the first few years of business when cash is often tight.

Fast Funding

Since there aren’t any credit, collateral, or down payment requirements, the entire ROBS process from start to funded can be completed in as little as three weeks. This ultra-fast funding can be the difference between closing the deal or not when purchasing a franchise or an existing business.

Combining Financing

If you don’t have enough money in your retirement account to fund the business of your dreams, ROBS can still help in a big way. After the ROBS process is complete, you can immediately use the funds as the down payment on an SBA loan or another business loan — drastically increasing your overall buying power.

Established 401(k) Plan

The ROBS funding structure requires the establishment of a 401(k) plan, which has to be offered to employees to stay in IRS compliance. However, as a business owner, the ability to offer a 401(k) as a small business is a great recruiting tool. And just as importantly, as an employee yourself, it gives you the opportunity to continue to build your nest egg.

Rollovers for Business Start-ups can be a great stepping stone on your path to small business or franchise ownership. Ready to learn more, like what to look for in a third-party ROBS provider or how 401(k) business financing stacks up against other financing methods? Check out our Complete Guide to Rollovers for Business Start-ups.

Bobby Gill